This will help you track the returned merchandise and ensure that the vendor or supplier provides you with a credit for the returned items. Purchase return journal entries show that a company has directly reversed stock from their inventory back to their suppliers. Since goods purchase return journal entries reduce the outstanding payments of the company, they are recorded on the credit side. The purchase returns and allowances accounts exist due to the accruals concept in accounting.

How to record Purchase Returns and Allowances?

When you purchase inventory from vendors, there are times when those goods become damaged or cannot be sold as a result of a recall. In these instances, you can return the goods to your suppliers for a refund or credit toward future orders. The purchase returns and allowances journal is a Special Journal used to track these returns and allowances.

Why You Can Trust Finance Strategists

A buyer debits Accounts Payable if the original purchase was made on credit and the payment has not yet been made to a seller. To illustrate the perpetual inventory method journal entries, assume that Hanlon Food Store made two purchases of merchandise from Smith Company. Therefore, the supplier has to receive those goods back and make the subsequent entry in their accounts and ledgers to ensure that they can maximize the overall returns.

Ask Any Financial Question

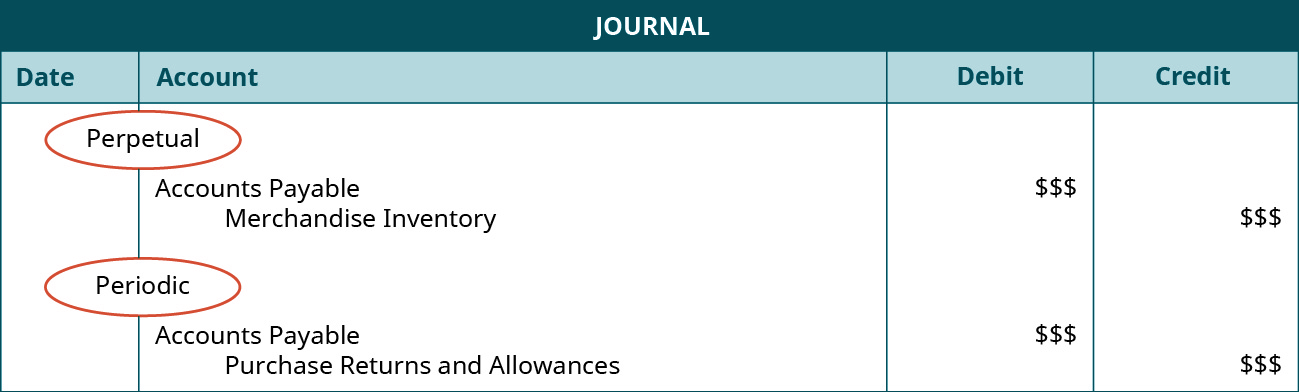

Companies using periodic inventory procedure make no entries to the Merchandise Inventory account nor do they maintain unit records during the accounting period. Under periodic inventory procedure, a merchandising company uses the Purchases account to record the cost of merchandise bought for resale during the current accounting period. The Purchases account, which is increased by debits, appears with the income statement accounts of the stock in the chart of accounts. As there are two methods of inventory accounting including periodic system and perpetual system, when the company returns the purchased goods, the journal entry in the two systems will be different. Hence, two companies that follow different inventory systems will have different journal entries for purchase return. Some companies may keep two separate accounts for purchase returns and purchase allowances.

- When a company purchases goods or services, it uses the following journal entries to record it.

- The entries are listed in more or less the same manner as invoices received are entered in the purchases book.

- Accounting for a purchase return with store credit is similar to a cash refund.

- Purchases are goods or services obtained or acquired to fund a company’s operations.

- In both cases, the accounts payable or accounts receivable account is debited, and the purchase returns and allowances account is credited.

11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. On 2 April 2016, Z Traders returned the full amount in cash to Y Merchants. The following are some selected transactions performed by Maria Trading Company during the month of January, 2018.

Understanding Debt Discounts: Types, Calculations, and Financial Impact

Upon delivery, Y Merchants found that the merchandise was defective and, therefore, could not sell it to customers. If a customer originally made their purchase on credit, the sale was part of your accounts receivable, which is money owed to you by customers. The Sales Returns and Allowances account is a contra revenue account, meaning it opposes the revenue account from the initial purchase. You must debit the Sales Returns and Allowances account to show a decrease in revenue. Debits and credits are equal and opposite, so when you increase an account using a debit, you must decrease another with a credit. In most cases, the customer receives a refund when they physically return the good.

For example, the goods may be faulty but still in an acceptable condition. Nonetheless, companies will require compensation in exchange for accepting below standard or faulty goods. Purchase returns, in short, are goods that a company returns to its suppliers.

Advanced inventory management systems, such as Oracle NetSuite and SAP, offer integrated solutions that automate the return process. These systems can track returns in real-time, update inventory levels instantly, and generate detailed reports, providing businesses with a comprehensive view of their return activities. Automation reduces manual errors and speeds up the return process, allowing companies to focus on more strategic tasks. Incorrect orders occur when the received goods do not match the purchase order specifications. This can happen due to errors in order processing, picking, packing, or shipping. Handling incorrect orders involves verifying the discrepancy, communicating with the supplier, and arranging for the correct items to be delivered.

Integrating purchase returns into inventory management also involves assessing the condition of returned goods. Items that are in resalable condition can be reintegrated into the inventory, while defective or damaged goods may need to be repaired, repurposed, or disposed of. This assessment process requires coordination between the inventory management team and quality control departments to determine the best course of action for each returned item. By efficiently handling returns, businesses can minimize waste and optimize the use of their resources. Effective documentation is another critical aspect of accounting for purchase returns.