For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. He is the sole author of all the materials on AccountingCoach.com. To learn more about the balance sheet, see our Balance Sheet Outline. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

Example: How to Calculate the Accounting Equation from Transactions

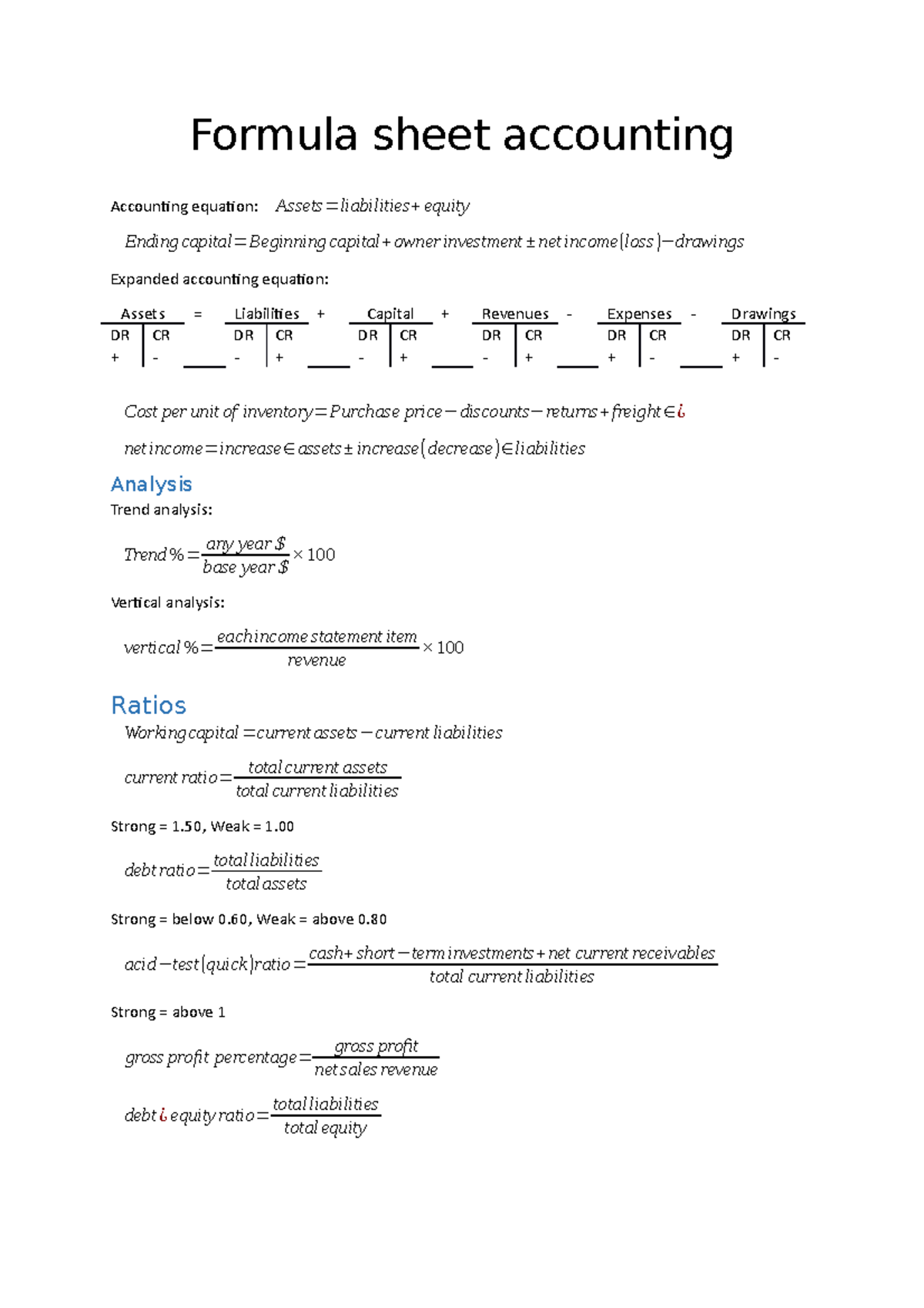

The equation must always balance out, underlining the concept of the double-entry bookkeeping system – every debit must have a corresponding credit, and vice versa. Valid financial transactions always result in a balanced accounting equation which is the fundamental characteristic of double entry accounting (i.e., every debit has a corresponding credit). All assets owned by a business are acquired with the funds supplied either by creditors or by owner(s).

What Is an Asset in the Accounting Equation?

That is, each entry made on the Debit side has a corresponding entry on the Credit side. It’s a tool used by company leaders, investors, and analysts that better helps them understand the business’s financial health in terms of its assets versus liabilities and equity. The accounting equation relies on a double-entry accounting system. In this system, every transaction affects at least two accounts. For example, if a company buys a $1,000 piece of equipment on credit, that $1,000 is an increase in liabilities (the company must pay it back) but also an increase in assets. For a company keeping accurate accounts, every business transaction will be represented in at least two of its accounts.

The Accounting Equation, Explained

If it’s financed through debt, it’ll show as a liability, but if it’s financed through issuing equity shares to investors, it’ll show in shareholders’ equity. The third part of the accounting equation is shareholder equity. The revenue a company shareholder can claim after debts have been paid is Shareholder Equity. The accounting equation states that the amount of assets must be equal to liabilities plus shareholder or owner equity.

Merely placing an order for goods is not a recordable transaction because no exchange has taken place. In the coming sections, you will learn more about the different kinds of financial statements accountants generate for businesses. That part of the accounting system which contains the balance sheet and income statement accounts used for recording transactions.

Assets Always Equal Liabilities Plus Equity

- He forms Speakers, Inc. and contributes $100,000 to the company in exchange for all of its newly issued shares.

- If you’re still unsure why the accounting equation just has to balance, the following example shows how the accounting equation remains in balance even after the effects of several transactions are accounted for.

- The accounting equation relies on a double-entry accounting system.

- The accounting equation is based on the premise that the sum of a company’s assets is equal to its total liabilities and shareholders’ equity.

- Drawings are amounts taken out of the business by the business owner.

Liabilities are amounts owed to others relating to loans, extensions of credit, and other obligations arising in the course of business. Implicit to the notion of a liability is the idea of an “existing” obligation to pay or perform some duty. Metro Corporation collected a total of $5,000 on account from clients who owned money for services previously billed. To learn more about the income statement, see Income Statement Outline.

If at any point the sum of debits does not equal the sum of credits, it may indicate a mistake has been made in the recording of financial transactions. The accounting equation stems from the double-entry bookkeeping system, a principle that mandates every financial transaction impact at least two accounts to maintain a balanced equation. Although the balance sheet always balances out, the accounting how to handle 3 critical stages of business growth equation can’t tell investors how well a company is performing. The accounting equation is also called the basic accounting equation or the balance sheet equation. We know that every business holds some properties known as assets. The claims to the assets owned by a business entity are primarily divided into two types – the claims of creditors and the claims of owner of the business.

Metro Courier, Inc., was organized as a corporation on January 1, the company issued shares (10,000 shares at $3 each) of common stock for $30,000 cash to Ron Chaney, his wife, and their son. Obligations owed to other companies and people are considered liabilities and can be categorized as current and long-term liabilities. So, let’s take a look at every element of the accounting equation. Capital can be defined as being the residual interest in the assets of a business after deducting all of its liabilities (ie what would be left if the business sold all of its assets and settled all of its liabilities). In the case of a limited liability company, capital would be referred to as ‘Equity’. Transaction #3 results in an increase in one asset (Service Equipment) and a decrease in another asset (Cash).

In this regard, it is also important to point out that assets can be termed as intermediaries that help companies generate considerable money. With this equation in place, it can be seen that it can be rearranged too. This equation justifies the financial position of the company, in the sense that the real worth of the company (Total Assets), has been financed using Liabilities (Leveraging) as well as Shareholder’s Equity. This arrangement can be ideal for sole proprietorships (usually unincorporated businesses owned by one person) in which there is no legal distinction between the owner and the business.

The Accounting Equation is the foundation of double-entry accounting because it displays that all assets are financed by borrowing money or paying with the money of the business’s shareholders. The balance sheet reports the assets, liabilities, and owner’s (stockholders’) equity at a specific point in time, such as December 31. The balance sheet is also referred to as the Statement of Financial Position. This equation holds true for all business activities and transactions. If assets increase, either liabilities or owner’s equity must increase to balance out the equation.

So, if a creditor or lender wants to highlight the owner’s equity, this version helps paint a clearer picture if all assets are sold, and the funds are used to settle debts first. A lender will better understand if enough assets cover the potential debt. In fact, most businesses don’t rely on single-entry accounting because they need more than what single-entry can provide. Single-entry accounting only shows expenses and sales but doesn’t establish how those transactions work together to determine profitability. While single-entry accounting can help you kickstart your bookkeeping knowledge, it’s a dated process that many other business owners, investors, and banks won’t rely on.